Reference Regulations

- Prakas No. 1447 MEF dated 26 December 2007, Ministry of Economy and Finance, on Provisions and Procedures on Customs Declaration.

- Instruction N0.1308 GDCE dated 24 November 2009 on Detail Procedures and Responsibilities in Functioning Customs Declaration (Single Administrative Documents-SAD) through electronic mean.

Procedures of Customs Declaration in ASYCUDA

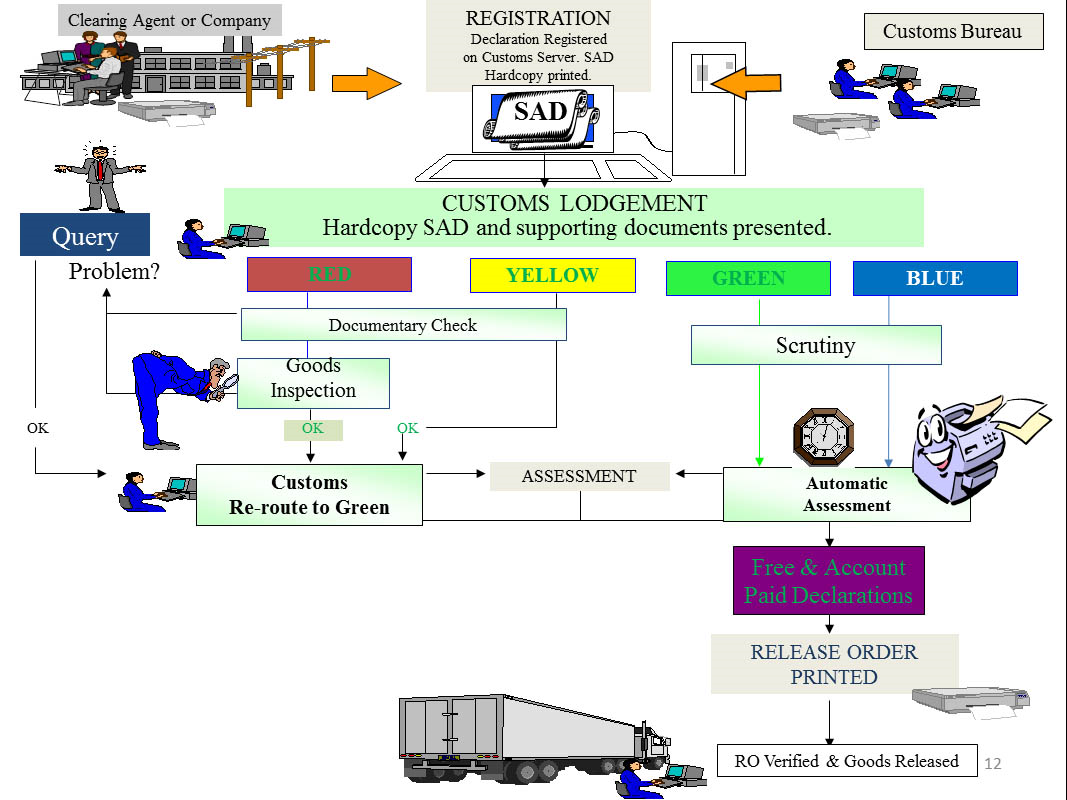

The Electronic lodgment of Customs Declaration (Single Administration Document-SAD) through new automated customs processing system called Automated System on Customs Data (ASYCUDA) follows the Processes in diagram of ASYCUDA below.

The general procedures to be followed by importers, exporters and their representatives for the electronic submission of customs declarations are described below:

1: Preparation and Printing of Customs Declaration

The Customs Broker/Declarant inputs information of SAD directly into the ASYCUDA. The computer checks and verifies the customs declaration with reference documents in the system, and performs some examinations. The system will allow registration of customs declaration when information is completed and valid. Registered customs declarations can be cancelled with authorization from the GDCE. Only registered customs declaration is considered legal document.

After registration, the Customs Broker/Declarant shall print and sign two (2) copies of SAD attached with all required documents and summit to competent Customs officer.

The system will automatically inform the Customs Brokers /Declarant about the situation of the customs declaration process.

2: Lodgment of the Customs Declaration

The customs officer in charge of face vetting examines hard copies of registered SAD and attached documents with information in the system to ensure that the SAD is properly filled, clear and legible and signed by the Customs Broker/Declarant, and all required documents are submitted together with the hardcopy registered SAD.

The customs officer may reject any SAD which does not fulfill the above requirements.

3: SAD Processing Lanes:

When the SAD is completely and satisfactorily checked, the customs officer assesses the SAD by using the system. By using risk management criteria, the system will assign the processing Lane for the Declaration as below:

RED Lane: The SAD must be scrutinized (checked against documents). Goods are subject to physical inspection before re-routing the SAD to GREEN lane and assessment by Customs.

YELLOW Lane: The SAD must be scrutinized (checked against the documents) before re-routing to GREEN lane and assessment by Customs.

GREEN Lane: The SAD is automatically assessed and a clearance document issued. The hardcopy SAD may be subject to post-clearance audit (PCA).

BLUE Lane: The SAD is provided the same treatment as for GREEN Lane and with specific reasons subject to post-clearance audit.

If customs declaration is under Red and Yellow lane, Customs officer shall verifies the selectivity criteria that caused the declaration to be set in these lanes. The system will show special requirements such as requirement for import license, withdrawal of sample and history of smuggling etc.

4: Query Desk:

If there are some errors in data entry or irregularities found during physical examinations, SAD will be routed to the Customs Query Desk. Customs Broker/Declarant will be notified that the SAD status has changed to “query” and the reasons for the query.

Upon receiving the notification, Customs Broker/Declarant shall go to the Customs Query Desk. If any amendments to SAD are required, Customs Officer in charge of Query Desk will discuss with Broker/Declarant. If agreement is not reached, the customs officer will prepare a report or record to GDCE for further action.

When the above action is fulfilled and agreement is reached, customs officer shall sign on SAD and update the inspection act based on the results of inspection and settlement at query desk or upon the decision of GDCE. Then SAD will be re-routed to GREEN.

5: Container Scanning

Container scanning is done independently of SAD processing. The system will be available in the Scanning Office enabling the scanning officer to compare the goods declared on the SAD with those found on the scanning image/scanning information.

Any irregularity found should be recorded in the Inspection Act Form by Customs.

6: Assessment Notice

When the SAD is assessed by the ASYCUDA, the system will inform the amount of duties, taxes and fees to be paid. The notice of assessment will be used as a reference document for payment of duties, taxes and fees.

7: Accounting

Duties, taxes and fees are paid in accordance with regulations in force. If payment is made via the National Bank of Cambodia or other authorized financial institutions, the receipt issued these institutes shall be submitted to Customs and the system will issues a Customs receipt in return.

8: Release of Goods

After payment of duties, taxes and fees Customs will issue the Cargo Release Note, which details the amount of duties, taxes and fees related to the declaration. This note is used to authorize release of the cargo from customs.

9: Post Clearance Auditing (PCA)

SADs processed under blue and green lane are subject to post-clearance audit.

Authorized User for SAD process

- Legal person or company with Value Added Tax certificate

- Owner of the goods or representatives

- Customs broker recognized by Customs

- Legally authorized Employee of the company

Required Documents for Customs Declaration

Documents to be attached with SAD:

- Invoice and Packing list

- Transportation documents (Bill of lading/ Airway Bill/Truck bill)

If necessary

- Manifests

- Licenses

- Permit

- Certificate of Origin

- Certificate of Insurance and

- other related documents

Responsibility of Customs Broker/Declarant in Customs Declaration

Customs Broker/Declarant shall perform the following responsibilities:

- Declarant shall input data on Customs declaration including valuation note until registration

- When finish inputting data on Customs declaration, declarant shall verify and then register Customs declaration if there is no mistake or after the correction of mistake. After registration ASYCUDA will provide registration number and date automatically.

- Declarant shall print 2 copies of the registered Customs declaration and valuation note (in case necessary) in A4 size paper (Note: Customs declaration can be printed after registration).

- Registered Customs declaration attached with necessary documents shall be submitted to Customs officer in charge face vetting. Declarant shall sign on Customs declaration in front of Customs officer.

- In case Customs officer in charge face vetting does not accept Customs declaration, declarant shall contact query desk official.

- If there is official in charge of manifest, declarant shall bring the copy of Customs declaration to Customs officer in charge of manifest in order to write off goods in Customs declaration from manifest.

- If scan is required, declarant shall bring the copy of Customs declaration to Customs unit in charge of scanning the container.

- If physical inspection is required, declarant shall contact chief examiner for inspecting the cargo.

- If additional information is need by Customs officer, declarant shall go to query desk.

- If payment is made via banking system, declarant shall provide bank receipt to Customs officer in charge of accounting in order to certify the payment in ASYCUDA.

- If payment is made on cash/check, declarant shall provide cash/check to Customs officer in charge of accounting in order to certify the payment in ASYCUDA.

- After payment of duties and taxes or in case goods are declared under advance payment, declarant shall receive Customs receipt from cashier and then Customs receipt on vehicle (if exist) and cargo release note of Chief of accounting.

- Declarant shall take transportation note from Customs officer in charge of warehouse or Customs area and then take the cargo out.

- In case there is an approval and permission to totally or partially return duties and taxes, declarant shall bring necessary documents include decision of the competent authority, Customs declaration, Customs receipt, Bill…etc to accountant and cashier in order to certify the return of duties and taxes in ASYCUDA.